When most people hear “fire‑rated glass,” they think expensive, slow, and painful to install. Our...

Why 2026 Looks Better for Viracon Projects

Tariffs, the Dollar, Europe – and What It Means for Your Glass Specs

For the past few years, many architects and glaziers have asked us some version of the same question:

“I want to buy American and I understand the logistics and tariff risks of importing glass, but these European prices are really low. How do I justify Viracon on this job?”

At Martineau & Company, we hear some version of that concern on a regular basis—from both architects and glaziers. Our view, based on watching the macro environment and living inside large project bids, is that the backdrop in 2026 is quietly shifting further in favor of Viracon‑based specs. Here’s how we see it, and why it matters for your work..png?width=500&height=100&name=Separator%20Line%20(1).png)

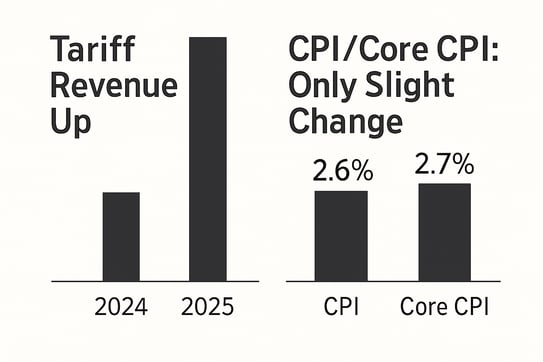

Tariffs Are Hitting Exporters – But Not Exploding U.S. Prices

Tariffs on imported goods, including glass and façade materials, are very real:

-

The CBO estimates 2025 tariff increases could reduce the U.S. primary deficit by about $2.5 trillion over 11 years if they stay in place through 2035.

-

Tariff collections jumped to roughly $90 billion between October and December 2025, up from about $20 billion in the same period of 2024.

If tariffs were being passed straight through to U.S. buyers as a “consumption tax,” we’d see it in inflation and import price data. We don’t:

-

Year‑over‑year CPI in December was 2.7%; core CPI was 2.6%; the monthly increase in core CPI was just 0.2%.

-

Non‑energy import prices rose only about 0.7% year‑over‑year in the September–November 2025 period.

-

Within imports, prices from China fell ~3.6% year‑over‑year, prices from Japan rose ~2.6%, and prices from the EU edged down about 0.1%.

As Daniel Lacalle notes in his Hedgeye article, this mix—surging tariff revenue without a spike in import prices or CPI—strongly suggests much of the tariff burden is being absorbed upstream, not fully pushed onto U.S. consumers.¹

In our world, that means:

- European glass producers shipping into the U.S. do pay U.S. tariffs on those imports.

- But rather than fully raising their U.S. prices to cover tariffs plus freight plus currency moves, many are taking the hit in margin and/or volume, and some of that burden is shared by freight, warehousing, and other parts of the logistics chain.

That’s why, in practice, we still see very low bid prices from certain European competitors, even though they are paying tariffs to sell into U.S. projects. The cost is real—it’s just not showing up as a big, broad price shock at the project level.

.png?width=500&height=100&name=Separator%20Line%20(1).png)

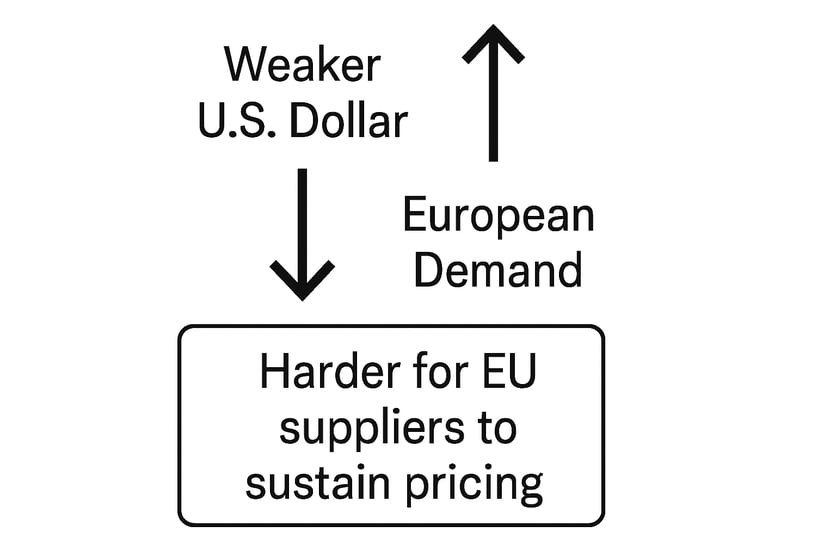

The Dollar and a European Rebound Tilt the Field Toward Viracon

Recent macro work, including Hedgeye’s analysis and FX trends, point to two important shifts for 2026:

- A trend of dollar weakness versus major exporter currencies.

- A potential rebound in Europe—stronger local demand and better utilization for European manufacturers.

This combination changes the export economics for European glass producers:

- A weaker U.S. dollar means each dollar of U.S. revenue converts into fewer euros.

- When tariffs are layered on top of that, the effective euro margin on U.S. exports gets squeezed further.

- If European demand is improving, EU manufacturers can sell more at home without dealing with tariffs or FX headwinds.

Put simply:

- It becomes much harder for EU suppliers to keep undercutting at any price.

- The incentive to:

- Push U.S. dollar prices artificially low,

- Absorb tariffs,

- Swallow FX losses, and

- Accept extended logistics risk

all at once diminishes as European markets become more attractive.

For your Viracon‑based projects, that likely means:

- The most extreme pricing gaps should narrow.

- On many jobs, it becomes easier to justify Viracon not only on performance and reliability, but on total cost and risk, without needing extraordinary discounts to match unsustainably low imported offers.

In other words, as tariffs, FX, and a European rebound converge, the macro environment becomes more favorable to U.S.‑based fabrication and less favorable to “race‑to‑the‑bottom” European pricing in our market.

.png?width=500&height=100&name=Separator%20Line%20(1).png)

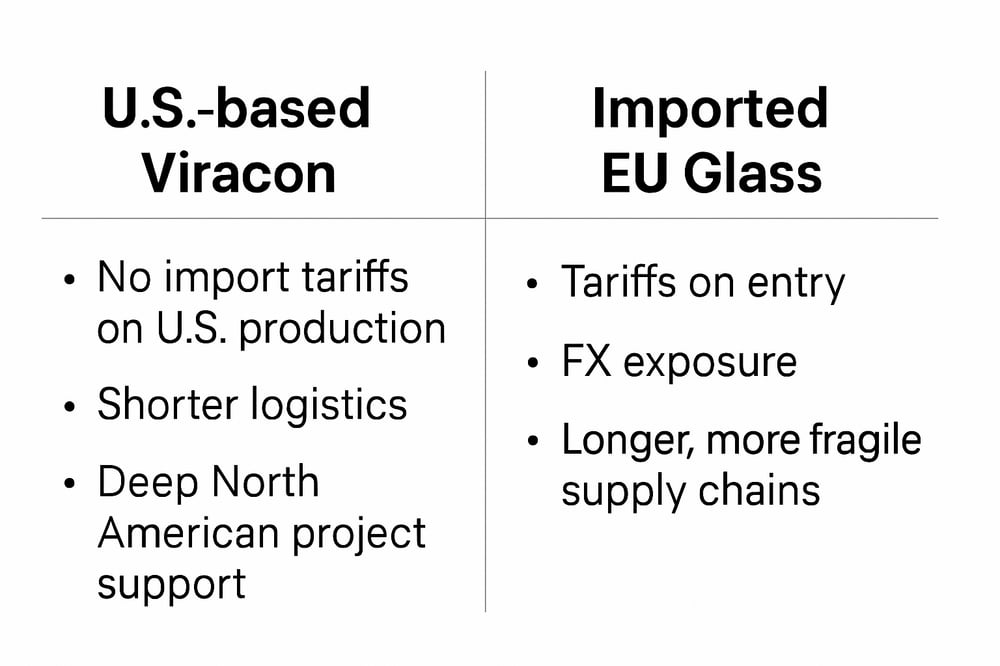

Logistics Chain Changes Matter Too

![]()

The last several years have also changed how we think about logistics:

- Ocean freight shocks, port congestion, and working‑capital strain during and after the pandemic have exposed just how fragile long‑haul supply chains can be.

- Where there is excess capacity in global exporting systems, the weakest links—often foreign producers and logistics intermediaries—tend to absorb more of the cost, whether from tariffs, freight swings, or currency shifts.

From a project perspective:

- Depending heavily on long‑haul imported glass means accepting more:

- Schedule uncertainty,

- Routing and port risk,

- Exposure to sudden changes in shipping economics.

- Leaning on a U.S.‑based fabricator like Viracon means:

- Shorter, more predictable supply lines,

- Better alignment with North American contractor schedules,

- Less exposure to tariff surprises and FX volatility.

As the logistics chain continues to rebalance, these advantages become more than theoretical—they’re reflected in fewer unpleasant surprises between shop drawing approval and glass on site.

.png?width=500&height=100&name=Separator%20Line%20(1).png)

Why This Strengthens the Case for Viracon in Specs

Against this backdrop, Viracon’s position looks stronger going into 2026:

- U.S.‑based fabrication: No import tariffs on Viracon’s own production for U.S. projects.

- Technical depth: Long history with complex façades, specialty coatings, and demanding fabricated glass systems.

- Local alignment: Closer cultural, scheduling, and logistical alignment with North American glaziers and GCs.

As European competitors’ ability to “dump” ultra‑low prices into U.S. bids erodes under tariffs, FX, and shifting logistics realities, Viracon’s combination of performance, support, and stability becomes more valuable in practice, not just on spec sheets.

For glaziers and architects, that leads to a simple takeaway:

When you choose Viracon, you are choosing a partner whose economics and operations are increasingly aligned with the realities of the U.S. market in 2026 and beyond.

A Brief Note on Tecfire and Fire‑Rated Glass

Although this post is centered on Viracon and high‑performance glass, there is a related development in the fire‑rated category:

Tecfire, our Spanish fire‑rated glass and frame manufacturer, is far along in establishing a U.S. manufacturing facility in Indiana, with operations targeted to begin by mid‑year.

For architects and glaziers, Tecfire’s U.S. plant will mean:

- Shorter and more predictable lead times on fire‑rated systems.

- Reduced exposure to long‑haul freight and customs delays.

- A stronger story for owners and institutions who care about U.S. manufacturing, BABA (Build America, Buy America), and supply‑chain resilience.

The Indiana facility is another example of serious manufacturers investing inside the U.S. to support North American projects better.

.png?width=500&height=100&name=Separator%20Line%20(1).png)

What You Should Watch for in 2026

As you design and bid projects in 2026–2027, it’s worth asking a few concrete questions when comparing options:

- Which suppliers are less exposed to tariffs, currency swings, and freight shocks?

- Who has the track record to support complex North American projects from design through installation?

- Who is investing in U.S.‑based capacity and logistics, rather than doubling down on long, fragile supply chains?

From our perspective at Martineau & Co, the changing macro environment—tariffs, a weaker dollar, a European rebound, and logistics rebalancing—makes Viracon a stronger, not weaker, choice for U.S. projects going forward.

If you’d like to walk through how these dynamics might affect a specific job or alternate bid, we’re always happy to talk through scenarios with you.

If you’d like to walk through how these dynamics might affect a specific job or alternate bid, we’re always happy to talk through scenarios with you.

.png?width=500&height=100&name=Separator%20Line%20(1).png)

Sources

-

Daniel Lacalle, “Do Americans Really Pay 96% of the Tariffs?”, Hedgeye, 2026.

https://app.hedgeye.com/insights/177255-lacalle-do-americans-really-pay-96-of-the-tariffs?type=guest-contributors%2Cmarket-insights -

U.S. Bureau of Labor Statistics (BLS) – Consumer Price Index (CPI), Core CPI, Import and Export Price Indexes.

-

Congressional Budget Office (CBO) – Tariff revenue and deficit impact estimates for 2025–2035.

-

Federal Reserve Bank of Atlanta – Business Inflation Expectations survey (showing firms’ cost expectations around 2.0% over the next year, the lowest in the post‑pandemic period).